Medicare Rates

MEDICARE PHYSICIAN’S FEES

Our practice is located in Florida. One of the advantages in living in this great State is the climate. It has traditionally been one of the favorite destination for retiree’s. That of course means than many residents of this state receives their medical benefits through Medicare or a Medicare equivalent plans.

Medicare was first signed into law in 1965. Initially, it was a program designed to help provide medical care for our citizens over the age of 65. In 1972, Medicare coverage expanded to cover our disabled citizens under the age of 65, as well as those with end-stage kidney disease. In 1986, hospice benefits were now permanently covered.

Because of the wealth of the United States, the country (and rightly so) developed a mechanism to take care of the health of our elderly, diabled, and via medicaid, the poor. It was and still is a noble program and it has benefited many sick patients.

The Medicare benefits are paid by specific payroll taxes. If you are employed, you will pay 1.45% of your income to Medicare. An additional 1.45% is paid by your employer. If you are self-employed, you will pay 2.9% of your earnings in Medicare taxes. From the standpoint of the economics, it sounds like a great deal, as at most, you will pay less that 3 % of your income for medical care (less deductibles) from age 65 onwards.

But, unfortunately, all great deals usually mean someone is getting a bargain, and someone is short changed. The US Government has known for a long time that the current Medicare system is headed for a fiscal crisis. The reason for this crisis is multi-factorial.

1. People are living longer. In 1965, on average the life expectancy was 70.2 years. In other words, once you became eligible for Medicare, you would use it on average of only 5.2 years. In 2011, on average the life expectancy is 78.6 years. In other words, you will now use Medicare benefits for 13.6 years. Your great deal, became even greater.

2. Medicare Benefits have significantly expanded. As stated above, initially, it was only for those over 65. Then it covered the disabled, and the kidney failure patients. Then it covered hospice care. Now, after 2003, it covers prescription benefits. While we some would argue covering hospice, and prescriptions may lower some costs, unfortunately, by expanding into these benefits, you have increased the complexity of the program. And as you all already know, that means more management costs, compliance costs, and probable fraud.

3. Medical technologic advancements are very costly. In 1965, while the hospital provided good care, it did not have the modern tools such as CT scans, MRI’s, Intensive Care Units and highly trained specialists. These advancements helped to increase our life expectancies. All these things are good. But, the designers of Medicare did not anticipate the rapid increase in technology, and the costs associated with it. Unfortunately, from the fiscal perspective, medical care led to longer life, which leads to more costs.

4. Lack of Consensus on coverage of Benefits. Every day, medical science is developing a new advancement. Some of the new cures are limited to a very small population. Some of these cures are very costly. Some of these technologies do not have any long term data supporting their use. In these scenario’s the administrators of Medicare often will try to limit the coverage of these technologies. But, as medicare beneficiaries, patients feel they have contributed into the system with their tax dollars, and want these services covered. Every medical condition has its national organization that campaigns for inclusion of that technology as a coverage benefit. The cynic would also argue that the businesses that funded the development of these treatments and technologies will also lobby for coverage, whether data supports inclusion or not.

So, how has the Medicare Adminstrators attempted to reign in cost? Since 2003, the fee’s paid to physicians and other medical providers have seen a steady drop. This was secondary to the SGR (Sustainable Growth Rate) formula used to adjust physicians fee’s by the volume of services rendered. The formula was initially utilized in 1997. The plan was not to decrease the costs of the providers of Medicare, but instead to assign a value for each covered service. Then, based on utilization of these services, the actual allocation of funds to providers would be made. The pool of money would theoretically be the same. This methodology was effectly, a new way to distribute the revenues to the various providers. Essentially, it pit one group against another. Over time, as the number of Medicare beneficiaries increased, as the beneficiaries lived longer, and as new technologies and treatments were covered, providers were receiving less and less each successive year, for the same level of service.

But in 2009, the physicians as a group, decided they could no longer afford the yearly cuts. The level of reimbursement was almost matching their cost of doing business. All over the nation, physicians, and physicians groups were dropping out of participation of the medicare program. In the end, physicians had to make a business decision. Any further drop in Medicare Fee reimbursement would essentially cause treating Medicare patients to be a loss to their business. And, as there is no negotiation of fee’s set by Medicare, there would be no option but to drop participation in Medicare. Because of the concerns of access to physicians, further cuts have stopped for now. But the future is still uncertain.

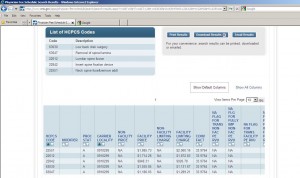

So, how much are the doctors making on their procedures? When I polled my patients, they assumed spine surgeons are being paid handsomely for their high risk and complicated procedures. But, unfortunately, that is not the case. Below, find the 2011 fee schedules for typical spine surgeries paid by Medicare. As a physician, if you are only caring for the Medicare population, unfortunately, you will need to do a volume of procedures to cover your overhead.

MEDICARE WEBSITE

Last modified: October 22, 2019